Current U.S. efforts to slow China’s technological advancement focus on semiconductors. Washington targets electric vehicle batteries, another rapidly growing Chinese tech sector.

This month, Treasury and Energy Department proposals would reduce tax credits for electric vehicle buyers who use battery materials from China and other “hostile” countries. EVs made in the U.S. with mostly domestic materials are eligible for up to $7,500 in subsidies under President Joe Biden’s signature climate law passed last year.

Last week, China’s Ministry of Commerce said U.S. rules “discriminate against Chinese companies and violate WTO rules.” The ministry called the exclusion of Chinese suppliers from U.S. tax benefits “typical non-market-oriented policy and practice.”

In a new era of decoupling, the rules aim to reduce the U.S.’s dependence on China’s supply chains, which would likely hinder Biden’s efforts to boost EV sales as part of the president’s plan to cut greenhouse gas emissions in half by 2030.

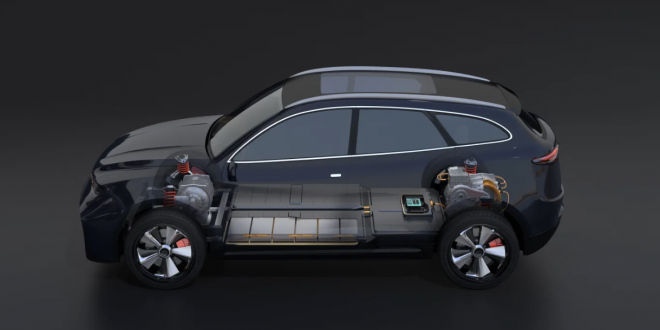

The U.S.’s desire to restrict China’s hegemony in a sector that is rapidly expanding due to the adoption of electric vehicles is another issue. In the first ten months of this year, CATL and BYD, two of China’s largest battery makers, accounted for 53% of global EV battery usage, according to SNE Research.

According to Counterpoint, China held 58% of the global EV market in Q3 of this year, with the United States and Germany following.

Korean giants LG, Samsung, and SK On compete with China’s cheap and advanced batteries and are most likely to benefit from deteriorating U.S.-China relations. Korean firms are also struggling with the new geopolitical issues.

Ford and Hyundai have hired SK On to set up battery plans in the U.S., but its parent SK Group president Chey Tae-won recently blamed the U.S. for high battery costs. The battery arm of the Korean chaebol must now find non-Chinese materials. From rare metal mining to cell production, China controls the global EV battery supply chain.

Chinese battery companies want to build factories in America that qualify buyers for the EV tax credit to keep their prices low. Industrial giants like Gotion, BYD, and CATL plan to manufacture in the U.S., but they face challenges. As U.S. politicians scrutinize its deal with CATL, Ford has halted its $3.5 billion EV battery factory in Michigan.

Tech Gadget Central Latest Tech News and Reviews

Tech Gadget Central Latest Tech News and Reviews