Credit Karma Net Worth is a new product from the same people who make credit monitoring services. It helps people find out how much money they have, grow it, and keep it safe.

Credit Karma’s founder and CEO, Kenneth Lin, said in an interview that the new feature brings the company, which has been around for 16 years, closer to becoming a platform for managing all of a person’s money, from debt to building credit to checking and savings accounts.

He said that now that Credit Karma members have established credit and checked their credit score, they are thinking about the next step in their lives: their financial goals and outcomes.

Lin said, “This is really just the next step in helping that group of users understand their finances.” “Everyone tells us this is important, but no one has done it well, and more importantly, no one has made it as easy to access as we think we have at Credit Karma.”

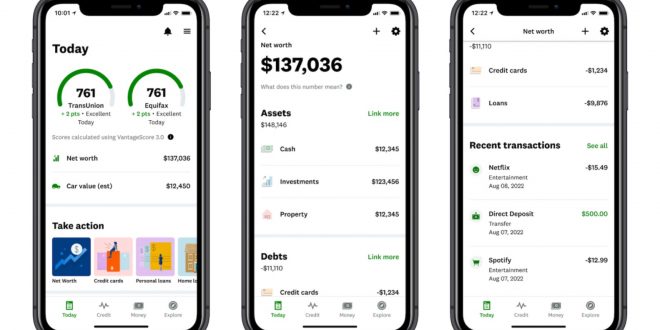

Net Worth’s main goal is to help members grow and protect their wealth, but when the product first comes out, the focus is on helping members understand the different parts of their net worth, such as assets, loans, retirement savings, and credit card debt, so they can keep an eye on it and see how it changes over time.

How it works is as follows: Members can link their financial accounts, such as a 401(k) or brokerage account, and debts, like a mortgage, that they still have to pay. All of these things together will give them an idea of how much money they have. Ryan Steckler, the general manager of Mint and Net Worth, said in an interview that members can then see their transaction history and track how much money comes in and goes out each month.

Steckler has worked for Intuit for 17 years. He joined the Credit Karma team six months ago, when Intuit’s Mint business joined with Credit Karma to make Net Worth. In 2021, Intuit bought Credit Karma.

Credit Karma has more than 120 million members in the U.S., but Net Worth is being rolled out to U.S. consumers with a credit score of 720 or above first, with the goal of expanding to a larger population over time.

These members are called “prime” because they are mostly in control of the first part of their financial journey. They pay their bills on time and are getting out of credit card debt. So, they have some money left over at the end of the month, but Steckler says they still don’t have the confidence to make the most of it and plan for the future.

Steckler said, “We’ve been helping people with credit scores in the middle for years, but we weren’t helping them with this, so people were outgrowing our app.” ” That was the reason why net worth was made. By bringing Mint into Credit Karma, we’re now taking advantage of that team and all the experience they’ve had helping “prime” members with their finances.

Tech Gadget Central Latest Tech News and Reviews

Tech Gadget Central Latest Tech News and Reviews