The eagerly anticipated demo day at Alchemist Accelerator is today, and visionary technical founders are in the spotlight as they present their promising startups in their infancy. Out of the 15 companies in this batch, there are four that caught our attention and deserve a closer look. Alchemist has managed to secure an impressive $2 million from Mayfield to continue their successful investment strategies. Clearly, they are making all the right moves.

Tune in at 10:30 Pacific time today to catch the complete lineup of presentations.

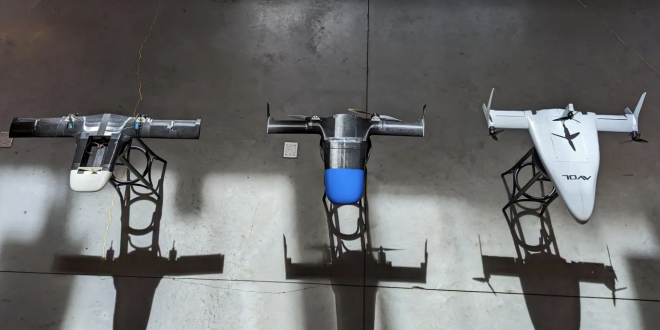

Avol Aerospace can be seen as an American counterpart to Matternet’s medical sample transport drones in Switzerland. Over the years, I’ve had the opportunity to explore and evaluate various concepts. One such concept that caught my attention is remarkably intricate, yet holds immense potential for enhancing efficiency in tasks like lab work completion, organ and blood transportation, and more. It presents a compelling alternative to traditional ground couriers.

It’s no surprise that in a Swiss city filled with medical centers, flying a quadcopter is not a big deal. If you’re looking for a solution that covers a distance of 50 miles, Zipline’s fixed-wing craft would be a suitable choice. Avol’s approach is quite intriguing, as they have developed a compact VTOL craft that seamlessly transitions into winged flight once it takes off. In order to streamline the launch process and overcome any potential obstacles imposed by the FAA, the company has implemented a remote pilot system. Just picture it!

While it may pose some limitations on scaling, it’s important to note that the sample delivery industry isn’t aiming to make a massive leap from 1 to a million. Rather, their focus is on a more modest growth from 10 to 100 over the course of the next year. Currently in the process of raising a seed round, they have set their sights on collaborating with hospitals across the nation.

Syntonym revolutionizes the world of video calls by seamlessly integrating the cutting-edge technology used by vtubers. With its real-time face replacement feature, it ensures utmost privacy during your everyday virtual interactions. Now, this particular use case is not intended for formal meetings with your team or video calls with your family. Instead, it is more suitable for applications such as in-car monitoring or telehealth, where capturing a person’s facial expressions and overall appearance is necessary, but without the need to store their face in a database.

This software offers multiple deployment options, including cloud service, on-premise installation, and even a virtual camera feature for mobile devices. A convenient on-screen indicator notifies users when their face is being displayed. The play is certainly intriguing, but one cannot help but question its marketability in light of the changing landscape of video calls and surveillance. Occasionally donning a mask would certainly add an intriguing element to the experience.

Indeed, ethical considerations do come into play. Let’s delve into the subject at hand!

Elaitra falls under the category of “AI radiology assistant,” which is quite extensive considering the growing prevalence of imaging for various medical conditions. When it comes to breast cancer, Digital Breast Tomosynthesis imaging has the potential to detect precancerous or suspicious tissues. However, even experts may struggle to interpret the results with absolute accuracy every single time.

Similar to other screening and diagnosis assistants, Elaitra’s Viewfinder software is not designed to replace expert analysis. Instead, it aims to enhance the efficiency and effectiveness of the expert’s workflow. The software is currently being tested in various hospitals and clinics, with the aim of establishing Viewfinder as an affordable and widely-used tool for breast cancer screening and treatment.

As a writer, I don’t claim to have a deep understanding of the practical applications of ERPs in daily operations. Traditional enterprise resource planning systems, on which businesses have relied for years, are, however, widely acknowledged to have difficulty accommodating modern workflows, particularly in industries that are rapidly evolving or small and medium-sized businesses. It comes as no surprise that individuals from Astra became so dissatisfied with their current setup that they decided to break away and create their own.

Redshift is their latest offering, an ERP-type solution that seamlessly integrates with popular modern services at a fraction of the cost. Admittedly, I must confess my lack of knowledge regarding the true purpose of these objects. However, it is worth noting that numerous companies have emerged from the rigorous realm of spaceflight, and this serves as a compelling narrative for their origins. A cut above the rest, truly.

Mayfield’s recent investment of $2 million builds upon their previous funding of $500K. It appears that they have a strong preference for technical founders, and Alchemist is well-known for catering to that niche. Surprisingly, they didn’t impose any significant conditions or requirements on the funding. “It’s an incredibly open-ended investment,” remarked Alchemist CEO Ravi Belani. “They were an LP at the beginning, so there’s a significant level of trust involved.”

The accelerator is experimenting with a fresh approach to connect with entrepreneurs worldwide who are seeking a reliable partner in the bay area.

“This experiment aims to establish connections with untapped regions of the world,” Belani explained. The strategy involves expediting the growth of startups recommended by partner firms. He mentioned a VC firm in Turkey called Simya, which interestingly translates to Alchemist. This firm happens to be one of the early partners.

“They are attempting to vie for the top startups in and around Turkey, but there exist larger funds than theirs,” Belani remarked. “Previously, the only option was to engage in direct competition, but now they have the advantage of being able to boast about the inclusion of Alchemist in Silicon Valley with our firm.” This provides them with a distinct advantage. If the company had chosen to approach us directly, our investment would have been a mere $50K. However, they have managed to secure a whopping $250K from their partner. This amount is the minimum requirement for this program, but they have the potential to receive even more.

Will it prove to be worth the investment? It has the potential to bridge the gap between the abundance of talent and capital that lack easy access to Silicon Valley, a region known for its insular nature.

Tech Gadget Central Latest Tech News and Reviews

Tech Gadget Central Latest Tech News and Reviews