With labor shortages becoming a pressing issue, various industries, including manufacturing and agriculture, are turning to AI as a solution for automation.

Computer vision startups are eager to capitalize on that opportunity by offering a variety of specialized solutions for both industries. Robots equipped with visual sensors are making their way into the agricultural industry, revolutionizing tasks such as data collection, crop monitoring, and harvesting.

Implementation is a significant challenge that needs to be addressed. If solutions are not user-friendly, they will not be adopted.

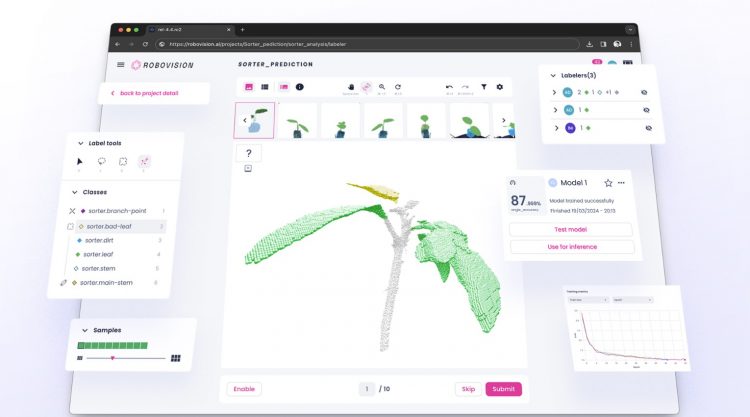

Belgian startup Robovision claims to have discovered a solution to that. Similar to a data scientist, the company aims to streamline deep learning tools and broaden their availability to businesses that may not have a strong tech focus. It has developed a computer vision AI platform that allows anyone to use it without the need for software developers or data scientists at every stage. Robovision focuses on assisting robotics companies in creating innovative machines that incorporate AI-driven automation, despite not directly manufacturing robots.

Practically speaking, Robovision customers have the ability to utilize its platform for data uploading, labeling, model testing, and production deployment. According to the company, its model has a wide range of applications, including identifying fruit in large-scale supermarkets, detecting faults in newly manufactured electrical components, and even trimming rose stems.

A CEO named Thomas Van den Driessche told that Robovision already has customers in 45 countries, even though it is based in Belgium. Now, after getting a lot of money recently, it’s going to the U.S., hoping that industrial and agribusiness customers will be interested in that huge market.

Target Global and Astanor Ventures, a Belgian agtech investor, are both leading the $42 million Series A round. The second one is an investor based in Berlin. Its involvement in this fundraiser is different from some of the news it’s been getting lately, which is about problems with its ties to Russian money. Red River West, a French venture capital firm that helps European startups get into North America, also took part in the round.

Robovision has raised a total of $65 million in equity funding, which includes two converted notes. The company is now worth $180 million after the new round of funding. Florian Hendrickx, Robovision’s chief growth officer, told me via email that this still means that the founders and staff own more than half of the company.

Why is this important?

Working with different industries makes Robovision’s messaging and go-to-market strategy more difficult, which is one of the problems it faces as it grows. The good thing is that experiments and lessons learned in one area can be used in another. During the COVID crisis, Robovision was able to use some of the 3D deep learning it had created to find diseases in people’s lungs.

“It’s a two-edged sword,” founder Jonathan Berte told. “Harnessing the fine line between variety and focus has always been in Robovision’s DNA.”

That DNA comes from Robovision’s history. It was started in 2012 as a consulting studio, and it took a few years before it switched to a B2B platform approach, which gained it more investors.

Van den Driessche said that 50% of Robovision’s work is in agtech, which is where it first gained traction. Agtech is also where Astanor, one of the co-lead investors in Series A, comes from. The main thing that company does is what it calls “impact agrifood.”

Agtech is a big chance because of the lack of workers and because Robovision has a track record—every year, it helps its partner ISO Group plant a billion tulips. Van den Driessche said that Robovision is growing faster in other areas.

Dr. Van den Driessche says that Robovision is becoming very popular in both life sciences and technology. Hitachi, for example, makes semiconductor wafers on its platform. A partner at Target Global named Bao-Y Van Cong said, “I don’t think agriculture is going to be the biggest sector at scale.” “I think it will be making things for industry.”

Apple’s recent decision to buy DarwinAI, an AI startup that specializes in keeping an eye on how parts are made, shows that more people are becoming interested in this area. For Jonathan Berte, the founder of Robovision, it’s also a sign that it makes more sense to have a toolbox that can handle a lot of different industrialized uses. “Apple would not have bought that company if it was only a one-time fix.”

From Ghent to the rest of the world

After its change, most of the convertible notes that Robovision raised in 2022 and 2023 came from investors in the Netherlands and Belgium. However, the company had to look further afield to get the money it needed. Robovision raised a lot of money in the round. To get that much money from Benelux, it might have been harder or would have needed more dilution.

Robovision’s roots in Belgium are paying off in more ways than one. Berte said, “The early team was made up of very smart people from Ghent University.” Van den Driessche took over as CEO of Robovision in 2022, and Berte turned his attention to raising money, making partnerships, and expanding the company around the world.

In response to customer demand, Robovision has also changed the way its computer vision tools are built as part of its tech evolution. It came out with Robovision Edge because low latency and delivery speed are needed in some settings.

To compete globally in today’s market, you need to be able to do more with less. Van Cong said, “I think the only way to do that is to come up with new ideas and work harder.”

Tech Gadget Central Latest Tech News and Reviews

Tech Gadget Central Latest Tech News and Reviews