To expand the cross-border payment and remittance markets, Strike, a financial app and payment network based on Bitcoin, is entering the Philippines.

According to Jack Mallers, CEO of Strike, “the Philippines is one of the largest remitting markets in the world, especially from the United States.” According to Statista data, approximately $12.7 billion in cash remittances were sent to the Philippines in 2021 by Filipinos living in the United States.

International payments are a major hassle and always have been, so as far as the technology we build, it’s one of the lowest-hanging fruits. Despite Western Union and SWIFT’s incremental innovations, the situation is still very challenging.

Traditional cross-border money transfer services are slower, even between Western nations, because bank transfers can take several days to move money from one account to another.

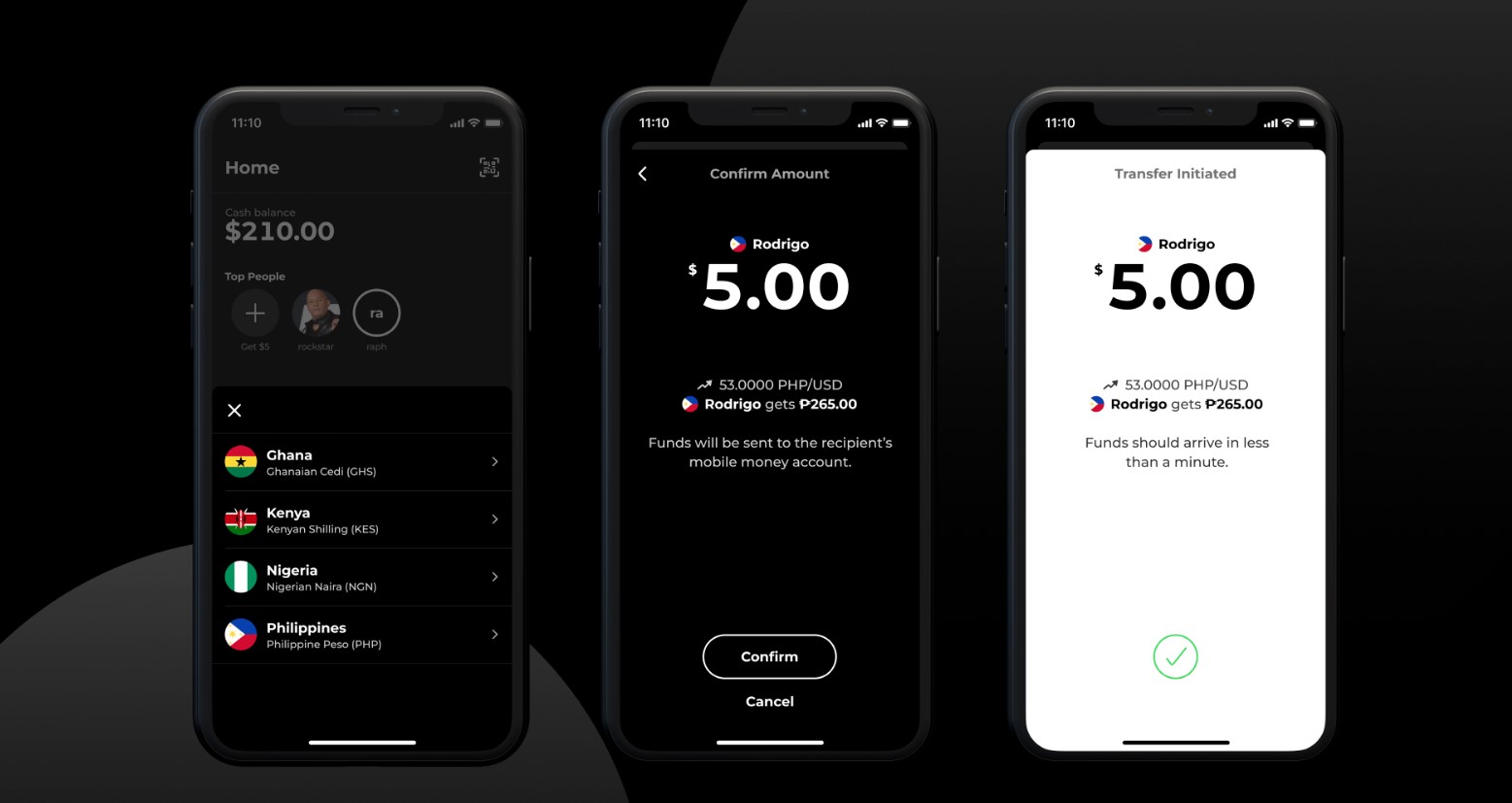

Strike uses the Lightning Network, a layer-2 payment protocol built on top of Bitcoin, which enables millions to billions of transactions per second to take place across the platform. Lightning Network micropayments are immediate and inexpensive. According to Mallers, the platform of the app also enables users to send US dollars to regional fiat currencies, such as the Philippine peso, for a fee of less than a cent per transaction.

None of our users must interact with Bitcoin, according to Mallers. Regardless of its cost, the app uses Bitcoin to transfer funds from one user’s account to another. In order for users to take advantage of Bitcoin’s payment network, he continued, “The business’s aspiration is to hide Bitcoin under the hood.”

For instance, the Lightning Network enables the conversion of Bitcoin into local currency “in the order of seconds to minutes as opposed to days or weeks” when a customer wants to send $5 to a location like the Philippines.

Due to the “extreme amount of demand,” Mallers said, Strike plans to grow even more outside of the Philippines in Latin America and Africa. “Partners are sprouting up all over the place,”

Strike is now in high demand, with partners looking to integrate it everywhere from the United Kingdom to the rest of Europe to “20 new countries we’ll potentially add in February in Africa,” according to Mallers.

This month, Fiserv, the parent company of Clover (the posh white digital register found in many small businesses today), partnered with Strike to expand its services.

According to the business, it raised $80 million in a Series B round last year to support its efforts to expand its payment solutions for retailers, online marketplaces, and financial institutions. In August 2022, Strike and Visa collaborated to introduce a rewards card that works with its application.

The company’s announcements and partnerships generally indicate that it is focused on expanding the remittance market through its application and other non-traditional channels, like Clover.

The objective, according to Mallers, is to make international and cross-border payments more affordable and quick. “But also easier to access. The value for financial inclusion is enormous.

According to Mallers, some Strike users will send their families as little as 10 cents. But he added that in a conventional financial system, the costs would outweigh the advantages. We can handle a $10 payment, and you don’t need to sign into Chase to send money overseas.

He continued, “In the future, there are opportunities to enhance the current remittance markets while also opening up new markets.” “You’ll start to see a renaissance of tools that are really closing that big delta gap, and you’ll start seeing more financial institutions like Square and CashApp take advantage of this,” the author predicts.

Mallers believes that over the following ten years, opportunities for the 2 to 3 billion people who are “generally included in the global international payments system” will be extended to include all 8 billion people.

That will be similar to a Renaissance moment, said Mallers. It is a very big deal.

Tech Gadget Central Latest Tech News and Reviews

Tech Gadget Central Latest Tech News and Reviews