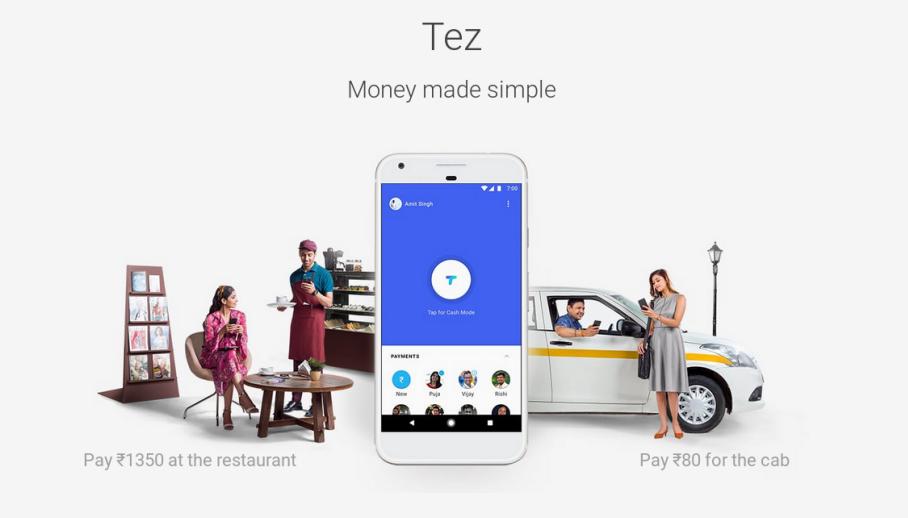

After quite some time it appears that Google is beginning to make a move into the Asian mobile-pay market. The tech giant has unveiled Tez, a new mobile wallet that will let users link up their phones to their bank accounts. This will allow them to buy things in shops and transfer money between friends. Tez is Google’s attempt to break into the Asian mobile pay market, leveraging India’s tech savvy middle class.

Tez is launching today for Android and iOS and will be linked up with a number of major banks using a UPI (Unified payment interface). This is a payment standard and system supported by the Indian Government in their ongoing attempts to move towards a cashless society. There are a number of supported banks including Axis, HDFC and the State bank of India. A number of on-line payment partners are also included. Tez works in a similar way to the Apple wallet. Rather than topping up the app and paying that way the account is linked directly to your bank account, similarly to a debit card.

Google also have a way to help Tez overcome the Indian language barrier. India is an incredibly large country with around 438 distinct spoken languages. The app will have translations available for; English, Hindi, Gujarati, Kannada, Tamil, Telugu, Marathi, and Bengali. This doesn’t come anywhere close to 438 but Google will hope that it is enough of a mix for the app to gain popularity across the enormous country.

Tez will transfer money using AQR, an audio based format. This essentially sends an ultrasonic sound-burst containing code to another device, authorizing it to send the transaction. Google has never used this system for payments before but it has been utilized in the chrome-cast for quite some time. This simplicity will greatly assist Google’s attempt to break into the Asian mobile pay market. Low cost smart phones are very popular in India and many of these do not include NFC payments. Using AQR means that cheap smartphones will still be able to take advantage of Tez. It means that in theory consumers will be able to use Tez on any device that has a screen and a speaker.

India is the beach head in Google’s attempt to break into the Asian mobile pay market

The fact that India is the first stop in Google’s attempt to break into the Asian mobile pay market makes sense. India is the 2nd most populous Asian country with a rapidly rising middle class with a strong interest in tech. The market has traditionally proven resistant to attempts to introduce credit cards. This gives Google a large gap in the market to exploit.

The name Tez is no coincidence. In Hindi it means fast and Google will hope that they can push their new product as the convenience choice for a new busy lifestyle. The tech giant will hope that the lack of debit cards and the governments push towards a cashless society will allow Tez to flourish in a way that it can’t in a Western market.

While mobile pay has grown significantly in popularity in the West is has been hampered by the ubiquity of credit and debit cards. Many of us are reluctant to give up our plastic cards and put even more emphasis on our phones. If Tez proves a success in a market like India then Google is planning to roll out into the rest of Southeast Asia. Indeed the tech giant has already patented the name in India and the Philippines.

The service will be free to use for ordinary users and small businesses. It will even include a section where anybody can set up to receive payments using Tez. This platform will include options such as loyalty cards, discounts and bonuses for purchasing products using Tez.

Google is really pushing to take over a huge market. Tez might mean fast but it will take some time before we can see whether Google can finally convince India that cash is the past.

Tech Gadget Central Latest Tech News and Reviews

Tech Gadget Central Latest Tech News and Reviews