Infrastructure for charging EVs is among the biggest bottlenecks in the EV rollout. There are many businesses trying their hand at it, but Orange thinks it has a more intelligent strategy. The company makes it incredibly simple for building managers to install sockets specifically for overnight charging of vehicles while working within the typical constraints of multifamily dwellings (think apartment buildings, etc). (as opposed to the high-voltage, high-amperage chargers you see in fast chargers).

Making the sockets as simple to install as a typical household outlet is the company’s secret weapon, and it also makes it simple for building managers to charge tenants based on usage. Car owners must use the 110V or 240V cables that came with their vehicles since the company decided not to include the charger cables. This, according to the claim, extends the chargers’ uptime.

“Replacing a car cable costs around $200, and Amazon delivers them the following day. That is significantly less expensive than the alternatives: “A lot of the time, it costs more than that to just have an electrician show up in a truck,” notes Orange CEO Nicholas Johnson.

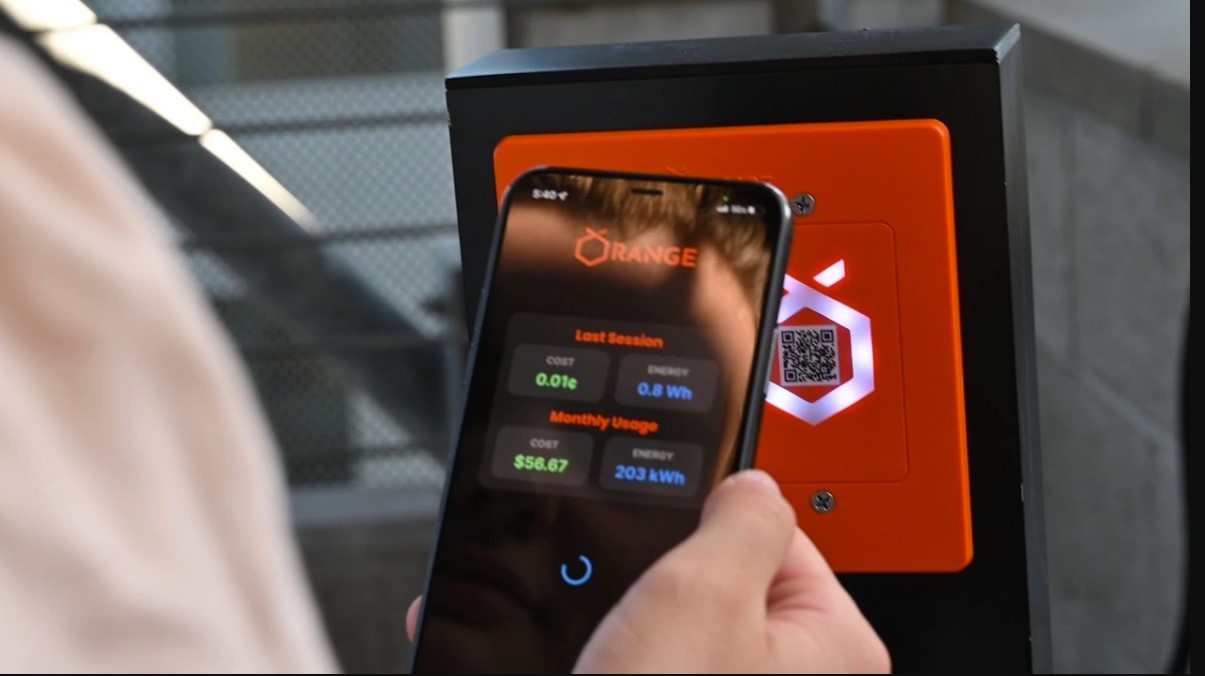

To get around the problem of poor cell signal that frequently exists in garages, each of the boxes has cellular, Wi-Fi, and Bluetooth connectivity. Wi-Fi mesh networking is currently being added by the company so that each socket can increase the range of each other socket. Additionally, the sockets don’t require an internet connection to begin charging because a user’s phone connects via Bluetooth and monitors the charge level.

Johnson continues, “The mesh network is actually only there for notifications. “Like if someone unplugged your car, or like if something went wrong. Additionally, we use the network for our own data metrics, temperature readings, and any future updates we might add as we enhance our firmware.

“Orange has achieved equitable access to electricity by re-thinking the entire process of vehicle charging and developing a system specifically for apartment communities, rather than pushing a public charging model that doesn’t fit onto them.” “Today, the majority of charging infrastructure is sold as these expensive pedestal boxes that are unnecessary for charging a car. Instead of using their entire battery range, most people drive 30 to 45 miles per day. Charging virtually disappears from your life as long as you have a reliable outlet and can charge your car. When you plug it in when you get home, it is ready for you every day when you leave for work.

The company makes it clear that it wants to run its business using a more compelling, sustainable business model and tells me that it is fighting with competitors like grant-funded ChargePoint charging stations.

Our main selling point for a property owner is that we can offer cheaper initial installation costs. Then, when we sell electricity again, we can show a profit. That is the delicate balancing act: A resident of a multifamily building might have to pay more for electricity than one in a single-family residence. However, they also didn’t have to pay to install a charger because it was already paid for. Over a payback period of three to five years, the charger’s cost is amortized. Then, over a ten-year period, you receive a return on investment that ranges from 150 to 200% of the infrastructure’s original cost, according to Johnson. “Panel capacity is the additional problem. There is a limit to how many EVs can charge simultaneously in each building today. As more EVs enter the market, how do you charge them all?

The business is making the wager that more low-amperage chargers scattered throughout a garage are preferable to a small number of Level 2 high-speed chargers located in an apartment building.

Five $6,000 stations were being installed by people in communal parking spaces. However, it doesn’t work because the tenants don’t get up at midnight to move their cars, Johnson notes. According to data, cars charge for three hours before sitting idle for six. Then the owners tack on fees, and we’ve talked to drivers who were receiving $40–$50 charges every few weeks because they neglected to move their cars on time.

Currently, there are approximately 500 outlets spread across 75 locations, and the company is working to hasten the rollout. The business claims that large multifamily developers are its sweet spot.

We target construction companies like The Essex, Irvine, Camden, and Greystars around the globe. The huge shift in EV ownership means that property managers are all attempting to address the same issue, Johnson says, whether they are managing 50 or 60,000 units. “We don’t go after Tesla owners who want to charge their cars at their condos; we go after developers. Although we enjoy working with them and selling to them, we don’t see the greatest value there. In addition, HOAs move slowly. Because the HOA board must approve the transaction, it typically takes six to seven months to close.

Late last year, the business closed a $2.5 million round with just one investor, Baukunst, who also contributed to Orange’s entire pre-seed round. The business informs me that it is preparing to soon raise a larger round, hire more people (especially front-end developers), and increase socket production through its contract manufacturer.

Tech Gadget Central Latest Tech News and Reviews

Tech Gadget Central Latest Tech News and Reviews